sharebazar_eps_commercial_bank

While making an investment decision, we look into various financial ratios of the particular company. These ratios are very important to analyze the strength of the company before investing in it. Most investors use various ratios to analyze the company, among which the most popular and widely used financial ratio in share market is EPS(Earning per share).

What is an EPS in Commercial Bank?

EPS stands for Earnings per share and is one of the most widely used financial ratios in fundamental analysis. It serves as an indicator of a company’s profitability.

You can check the earnings per share of any stock from their balance sheet. Companies with high EPS are considered more profitable than those with lower EPS.

An intelligent investor always selects stocks with higher EPS. It is considered advisable to choose stocks whose EPS is more than 15 (EPS > 15). Also, remember you should always compare the EPS of companies within the same industry.

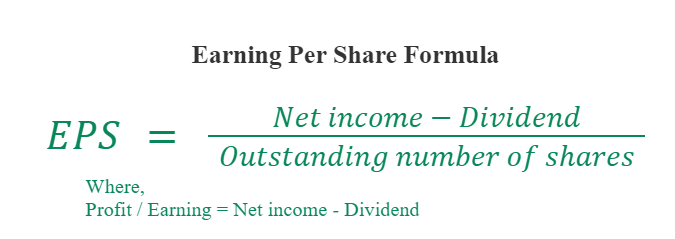

How is EPS calculated ?

EPS are calculated by dividing a company net income by its number of share outstanding. EPS indicates how much profit company makes on each share.

EPS of commercial bank in Nepal

The data shown below are the EPS of commercial banks in Nepal as per the financial report of its fiscal year 2080/81 Q3 unaudited report. The EPS of the company changes from quarter to quarter.

Top Commercial Bank EPS in Nepal

| Bank | Symbol | LTP | Earning Per Share |

|---|---|---|---|

| Agricultural Development Bank Limited | ADBL | 223.4 | 32.26 |

| Citizen Bank Limited | CZBIL | 158 | 15.18 |

| Everest Bank Limited | EBL | 497 | 29.9 |

| Global Ime bank Limited | GBIME | 175.3 | 18.03 |

| Himalayan Bank Limited | HBL | 179.6 | 17.62 |

| Kumari Bank Limited | KBL | 135 | 6.91 |

| Laxmi Sunrise Bank Limited | LSL | 150.9 | 9.14 |

| Machhapuchchhre Bank Limited | MBL | 171 | 14.04 |

| Nabil Bank limited | NABIL | 429.9 | 27.03 |

| Nepal Bank Limited | NBL | 205.7 | 19.27 |

| Nic Asia Bank Limited | NICA | 385 | 22 |

| Nepal Investment Mega Bank | NIMB | 152.5 | 11.76 |

| Nmb Bank Limited | NMB | 174.5 | 15.71 |

| Prime Commercial Bank Limited | PCBL | 188.8 | 14.4 |

| Prabhu Bank Limted | PRVU | 139 | 9.96 |

| Sanima Bank Limited | SANIMA | 233 | 18.2 |

| Nepal SBI Bank Limited | SBI | 274 | 18.82 |

| Siddhartha Bank Limited | SBL | 222.7 | 22.47 |

| Standard Chartered Bank | SCB | 515.9 | 37.1 |

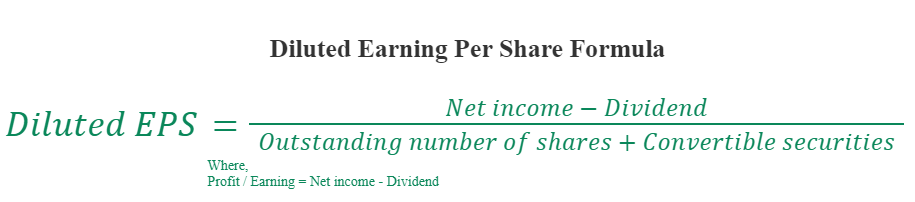

Diluted EPS

Diluted EPS are calculated if company has any convertible securities like outstanding convertible preferred shares, convertible debt, equity options(mainly employee-based options) and warrants.

Disclaimer – “The content on this site is provided solely for educational purposes to empower users to make informed financial decisions. We do not recommend buying or selling decisions. We are not financial advisors. We are not responsible for any loss of capital incurred by readers based on the actions they take using our information.”